Advantages and Disadvantages of Buying a Home with HUD

The United States Department of Housing and Urban Development (HUD) guarantees certain properties through the mortgage financing system. If a landlord defaults on his payments for any reason and the lender is insured by the FHA (Federal Housing Administration), then a repossession occurs.

This process is what converts the property into a HUD home. In this article, we will go into in-depth all the advantages and disadvantages of buying a home with a HUD.

If you decide to buy a home with a HUD, you should know both its pros and cons. For example, you must have the money to carry out the cash operation or an approved mortgage loan. If you are using the home as your primary residence, make sure it is insured as they are still eligible for FHA loans. They are properties that need less than $5,000 in repairs to make them habitable.

Advantages of buying a home with HUD

1. HUD Homes are an Option for Owner-Occupants and Investors

According to Brian Sullivan (Department of Housing and Urban Development Office of Public Affairs), the goal of HUD homes is to return ownership to unstable communities, although there are always tradeoffs for buyers.

“The initial period of commercialization to owner-occupants is to provide more stability in a neighborhood that has already experienced foreclosure.

Owner-occupants treat homes differently and HUD’s goal is to provide homeownership opportunities to eligible candidates. “

Investors have an opportunity in these properties as well, but they can only start bidding on a property after 16 days of it being listed.

Homes without HUD insurance are a bit different, allowing investors to start bidding on day 6.

2. There are protections to protect owner-occupiers from investors

Investors like the idea of buying a HUD home because they can rehab it, rent it, or sell it for a profit. When the property requires major repairs, it is more likely to be purchased by an investor, as owner-occupants typically avoid buying a home that needs complicated repairs.

The rehabilitation processes are not always attractive, therefore, these houses become an excellent opportunity for investors looking for inexpensive properties to repair, sell and make a good profit.

3. You can find HUD houses in several ways

You can find HUD properties on the authorized government website at any time. You can also request advice from a real estate agent to assist you throughout the process.

If you do well in your community, you will be able to see the signs on the windows of the houses that are part of this program.

After locating the HUB homes in your neighborhood, you can check the listing to see if they are insured, see the photos, and see if it’s worth making an offer on one.

4. HUD homes qualify for financing through the traditional mortgage process.

Although many people think so, the Department does not provide funding. Neither Financing fees are accepted by other investors.

However, most insured properties qualify for a variety of financing methods, including FHA loans, a 203K mortgage, conventional mortgages, private financing, and cash.

If you qualify for an FHA loan when you buy a HUD home, you will have mortgage insurance to protect the lender in the event of default. Some types of loans only require a 3.5% down payment, but you can only use a standard FHA loan to purchase HUD-insured property.

Read Also: Can A Mortgaged House Be Inherited? Heirs Options

5. No deposit is necessary until your offer is accepted

All deposits to HUD homes must be made with certified funds. If the property in question is worth $50,000 or less, then you must submit a deposit of $500 with a cashier’s check or money order.

Homes that exceed this valuation require a maximum deposit of $2,000, but never less than $500. The actual amount of the deposit depends on the guidelines of the Department of Housing and Urban Development, which can change at any time.

Your real estate agent should confirm the amount of the deposit with the property’s asset manager. However, it is recommended that you review the requirements yourself. After receiving the notification that your bid has been the winner, you must make the deposit within a period of time that does not exceed two days.

6. Your real estate agent must make the offer for the property

You won’t have to worry about the bidding process when looking for a HUD home. Your real estate agent is responsible for logging into the account to obtain the listing of the property you want.

They have 15 minutes to complete the offer from the moment they enter the system. No one can know how many bidders participate for the same property, nor can it be seen how much the participants will be bidding. You must rely on the experience of your real estate agent to offer a competitive amount, but not overvalued.

7. Most HUD Homes Sell Well Below Market Price

In the United States, the average HUD home sells for 85% of the market price.

However, some states have a much higher percentage. Hence the importance of seeking advice from a real estate agent.

The average supply in California, Florida, Texas, and Illinois generally reaches 92% of the market price. Since some properties cost $200,000 or more and an inspection and appraisal cannot be done before winning the bid, you should try to identify anything that requires major repairs yourself as you tour the home. It is important to ensure that you will not pay more than the market value by including the cost of rehabilitation.

8. The closing process is different for HUD homes

The closing process for a HUD home is a bit different when compared to a private sale. The Department of Housing and Urban Development will determine the timeframe and assign a closing agent to assist you with the transaction. Generally, you will have 30 days to close the deal after your realtor submits the full contract and HUD accepts it.

You must pay the fees for title searches, title insurance, and finding your own title company. The actual settlement is simple, paying the remaining balance of the sale price with certified funds or with financing, finally, you receive the keys to your new property.

9. There is less competition in the market for a HUD home

Because the HUD home buying process is more time-consuming than other options, you will have less competition than you think if you decide to bid on a property. This advantage applies to both investors and owner-occupiers.

Without a doubt, you will have the opportunity to make a good deal if you are patient with the purchase process. Since most people choose other avenues, this method of purchase or investment is exceptionally convenient.

Disadvantages of buying a home with a HUD

1. Some HUD homes do not qualify for a traditional mortgage

When you start looking for HUD properties in your area, you may find that most of them are classified as uninsured homes. This classification includes properties that require more than $5,000 in repairs to make them habitable. An inspector hired by the Department assesses the property and determines whether or not the repairs required by the property exceed this amount.

Those properties are being sold as-is, which means they won’t qualify for a traditional mortgage or an FHA loan. You will have to look for an FHA 203K loan or other types of financing or you do not have the cash to make a cash purchase.

2. Money from repairs should be placed in an escrow account

You must have $5,000 on hand, aside from the amount you need for the closing process, this represents an additional inconvenience for some home buyers.

3. You must commit to living in a HUD home for at least one year

HUD classifies an owner-occupant as someone who lives on the property 50% or more of the time. The property cannot be converted into a vacation home for the individual or family who buys it. It is also not allowed to buy an additional main residence.

By participating in the preliminary bidding period you will have the priority, as owner-occupier, of purchasing the property rather than an investor, as this program is intended to promote the property. However, due to their location, structure, or the repairs they require, some properties may not be suitable for occupancy.

4. A HUD Realtor is required to complete the purchase process

Most people search for HUD homes on their own and there is nothing wrong with doing so, but they should know that they will not be able to start the property purchase process without a HUD real estate agent, who is in charge of showing the house. and to make the offer in case you want to participate in the tender.

You should choose a broker agency that is already HUD-approved because the certification process can take up to six weeks. Your real estate agent can advise you throughout the process, including the deposit that you must make (non-refundable), the declarations about the property, and the list of repairs that are necessary.

Read Also: What Is The Cheapest US States To Live In?

5. The number of HUD homes for sale is usually quite low

Although HUD homes were very popular during the mortgage loan crisis and a few years after, the number of properties has dropped dramatically since then. In an investigation carried out in April 2019, among all the properties included in the Washington State list, only 10 options were available, with prices ranging between $63,000 and $287,000.

As the bidding period can be short, the total number of available properties can fluctuate dramatically. If you want to enter a house immediately, the options could be reduced to zero in your neighborhood. If you’re not in a rush, you might find a good opportunity to make your purchase.

6. Contractors and Property Inspectors May Not Detect All Necessary Repairs

When you start working with a HUD real estate agent to start your buying process, the first thing to do is prepare a tour of the home you are interested in so you can see everything. That visit is made with a contractor and a real estate agent. Then you must prepare your deposit to have everything ready in case your offer is accepted.

During the tour, it is important that you see and analyze all the details because the full inspection of the property cannot be done until your offer is accepted. If you can detect strong problems before putting money in, much better. If the costs do not seem too high, you can continue with the process.

7. Your purchase cannot depend on the inspection of the property

Unlike most other home purchase contracts, HUD does not allow a purchase to be contingent upon approval of an inspection. You have 15 days from the acceptance of the contract to carry out an inspection. If you decide to back out of the offer because there are major repairs that were not considered as part of the initial listing, it is up to the Department of Housing and Urban Development whether or not to return your deposit.

Don’t be surprised if they tell you that most deposits are not returned when this occurs, even if the number of repairs is very different from what was listed.

8. It may take several days for local utilities to connect services to the property

Because some HUD homes are disconnected from a community’s natural gas and energy infrastructure for a long time, the process of reconnecting all necessary services can take several days. You should contact all local companies before scheduling an appraisal or inspection, as both need access to the power system to complete a good look at the entire structure.

There are fees to reactivate services, which can sometimes be several hundred dollars. It is at the discretion of HUD to pay for it or make you pay.

If your home is in a colder climate and the purchase takes place between early winter and late spring, then you may have to pay to prevent the pipes from freezing. If utility workers detect a leak on the property, then they will not activate the necessary services, which means the appraisal and inspection may not continue.

9. The entire purchase process can take at least 6 weeks to complete

Assuming everything works out well, according to the HUD home search plan, it will take the average investor or owner-occupant at least six weeks to close the property purchase transaction.

In the first week, you will have to search and evaluate the properties that are available in your community. Then you must have the financing pre-approved and find a qualified real estate agent. By the third week, you will be taking the tour, preparing the deposits, and beginning to buy the house.

You will schedule the inspection of the property in the fourth week, within 15 days of accepting the contract. The lender will send an appraiser for non-FHA loans (FHA loans use registry appraisal). Then, you can finally initiate the closing of the trade.

10. You must have good financing for the experience to be successful

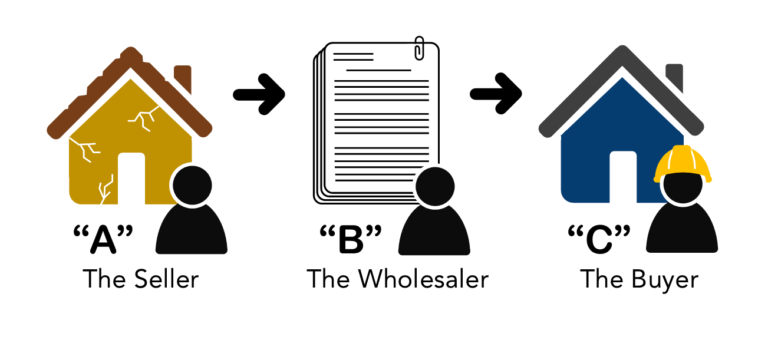

Since contract-related issues are unlikely to arise, you should have solid financing in place before starting the buying process. You can’t buy wholesale homes through HUD and it can be a complicated process, but also very rewarding.

Don’t be intimidated by the various rules, deadlines, and stipulations that are part of the entire process. A HUD-approved real estate agent can guide you through all the steps with relative ease. Then work with a lender (if necessary) to get the best financing options for your needs.

Recommended: How To Negotiate A Home Purchase (Expert Advice)

Conclusion

HUD homes represent an incredible investment opportunity. You can even save some money on an insured property if you plan to be an owner-occupant, as most will sell for less than the advertised value.

Since there are so many rules and requirements that you must follow, including the bidding deadlines that you must meet, it is necessary to have an experienced real estate agent who is familiar with these buying processes so that they can help you with each of the steps to follow.

Depending on where you currently live (or want to live), the number of days a HUD home stays on the market can be quite short. Florida properties generally sell in 17 days. Properties in Texas typically sell in 27 days, while properties in New York through HUD take an average of 61 days to sell. You may have to move quickly to secure the property you want.

The advantages and disadvantages of buying a home with a HUD are important points to consider when starting your home-buying process. Analyzing them can help you find the property that meets your specific needs.